The deal is done. The sleepless nights and hand-wringing are over. All the homes the Realtor showed were narrowed down to one and an offer was made. After a little negotiation – a little give and take - the offer was accepted and the Realtor said the sale “is in escrow.” What does it mean to “be in escrow” and what are the next steps necessary to consummate the sale?

What is "Being in Escrow"?

Very simply defined, an escrow is a deposit of funds, a deed, or other instrument by one party for the delivery to another party in exchange for the completion of a particular condition or event. The seller is promising to deliver an unencumbered deed to a property in exchange for “good and valuable consideration” (usually money) provided by the seller.

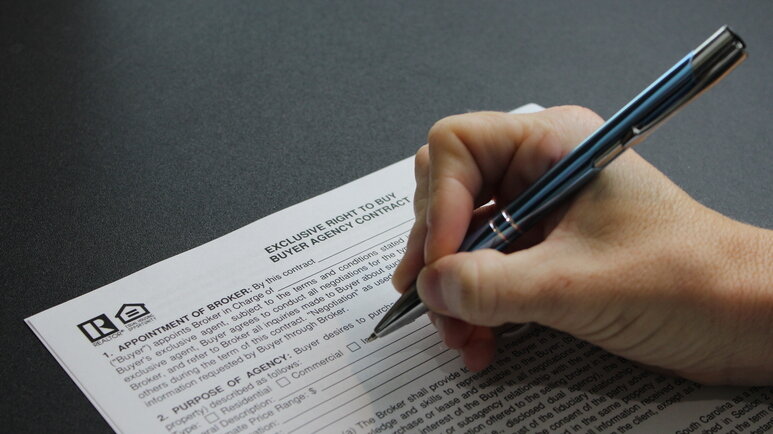

If it were only that simple! Most real estate transactions are full of “ifs, ands, or buts.” The principals to the escrow are the buyer, the seller, the lender, and the borrower. In most cases, they have created a list escrow instructions, most usually in writing, in the form of a real estate contract that is signed and delivered to the escrow officer.

If a broker is involved, he normally provides the escrow officer with the information necessary for the preparation of the escrow documents.

The buyer, seller, lender or borrower all want assurance that no funds or property will change hands until all the instructions in the transaction have been followed. The escrow holder has the obligation to safeguard the funds and/or documents while they are in the possession of the escrow holder and to disburse funds and/or convey title only when all provisions of the escrow have been complied with.

The escrow officer will process the escrow, in accordance with the escrow instructions, and when all conditions required in the escrow can be met or achieved, the escrow will be "closed." Each escrow, although following a similar pattern, will be different in some respects, as it deals with the terms of the sale of a specific property and a specific transaction.

The duties of an escrow holder include:

following the instructions (in most cases, the sales contract) given by the principals and parties to the transaction in a timely manner.

handling the funds and/or documents in accordance with the instruction.

paying all bills as authorized.

responding to authorized requests from the principals.

closing the escrow only when all terms funds in accordance with instructions and provide an accounting for same (the Closing or Settlement Statement).

How is an Escrow Transferred?

The selection of the escrow holder is normally done by agreement between the principals. If a real estate broker is involved in the transaction, the broker may recommend an escrow holder. However, it is the right of the principals to agree to an escrow holder who is competent and who is experienced in handling the type of escrow at hand. There are laws that prohibit the payment of referral fees. This affords the consumer the best possible escrow services without any compromise of service caused by a person with a conflict of interest. receiving a referral fee

The key to closing any transaction as important and as complex as a real estate sale, purchase, or loan is to fully understand the escrow instructions.

This is one of the most important services a Trembley Group Real Estate Sales Executive provides – explaining and helping the principals to a real estate transaction through escrow. If the escrow instructions are not understood, The Trembley Group Realtor is there with the answers.

What is an Escrow Officer?

An escrow officer is not an attorney and cannot practice law. While in South Carolina, most escrow officers are licensed attorneys, they are not in a position to give legal advice to the parties in a real estate transaction. If one of the parties to a transaction needs legal advice, they should consult a lawyer other than the escrow officer. Do not expect an escrow officer to offer an opinion as to whether a deal is “good” or not, or to give advice as to whether a sale or purchase is being handled in the right way. The escrow officer’s responsibility is to follow the instructions given by the principals in the escrow.

In order to expedite the closing of the escrow, the parties to the contract should contact the escrow officer and ask what can be done to move the closing of escrow forward.

Responding quickly to phone calls and correspondence will assist in the timely closing of the transaction.

If a purchaser or seller is required to deliver funds into the escrow, the principals need to be sure that "good" funds are in the form required by the escrow officer. Depending on the real estate company, lender, or escrow agent, procedures differ in this regard. If an escrow officer is given a personal check, it is unlikely that the escrow will close immediately. Escrow can only close on cleared funds, and the processing of a personal check can take days, possibly even a week or more.

When the escrow officer closes the escrow, some of the closing papers - checks, title policies, statements, etc. - may not be available immediately. There are many dimensions to the closing of an escrow, and some cannot be processed on the day of the closing. Some may take several days. Any special needs for documents should be made to the escrow officer early in the processing of the escrow.

Most real estate purchasers require a mortgage loan to close the sale.

If obtaining a new loan, the escrow officer contacts the lender who will need copies of the escrow instructions, the preliminary title report, and any other documents needed. In the processing and the closing of the escrow, the escrow holder is obligated to comply with the lender's instructions.

It has become a practice of many lenders to forward loan documents to escrow for signing. Purchasers/borrowers should be aware that these papers are the lender's documents and cannot be explained or interpreted by the escrow officer. A borrower has the option of requesting a representative from the lender's office to be present at closing for an explanation or to arrange a meeting with the lender to sign the documents in their office.

Watch The Trembley Group Real Estate blog for a future posting of PART TWO on the specific escrow responsibilities of the principals to a real estate transaction.

Whether buying real estate or selling real estate, an experienced Trembley Group Real Estate Sales Executive can make navigating contract to close as easy and seamless as possible. When it comes to closing Myrtle Beach and Grand Strand real estate, there are no experts with more experience or more knowledgeable than the Sales Executives at The Trembley Group Real Estate. They know all the ins and outs the Myrtle Beach and the Grand Strand real estate market.

Need help? Call The Trembley Group at 843.945.1880 ext. 100 and we’ll help you look for the perfect listing or buyers agent!

At The Trembley Group, we pride ourselves on being the experts at more than just selling real estate. We are local residents, some of us have been here for a lifetime. The rest of us will be here until the end of time. We love living, working, and playing in the diverse backyard of Coastal Carolina, and look forward to helping you live and love your dreams soon too. Please reach out to us by phone or email for personalized service and one-on-one advice.

About our blog

Our agents write often to give you the latest insights on owning a home or property in the Myrtle Beach, SC area.

If you’re thinking of buying a new construction home, I highly recommend hiring an agent, and there are a few reasons why.